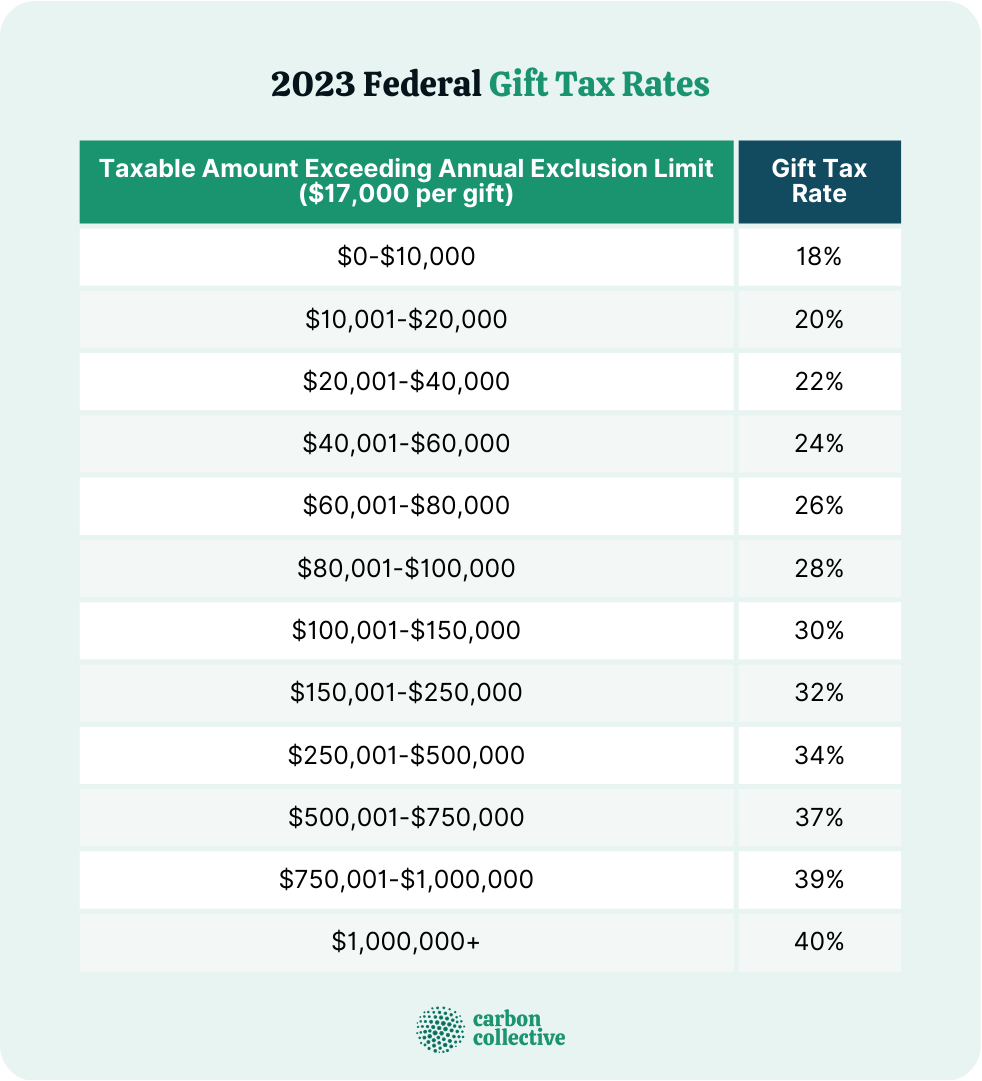

2025 Gift Tax Exemption For Individuals - 2025 Gift Amount Allowed William Bower, Effective january 1, 2025, the estate and gift tax exclusion amount and the generation skipping transfer. Gift Tax Rates 2025 Irs Ryan Greene, The irs released the 2025 annual inflation adjustments for various tax provisions.

2025 Gift Amount Allowed William Bower, Effective january 1, 2025, the estate and gift tax exclusion amount and the generation skipping transfer.

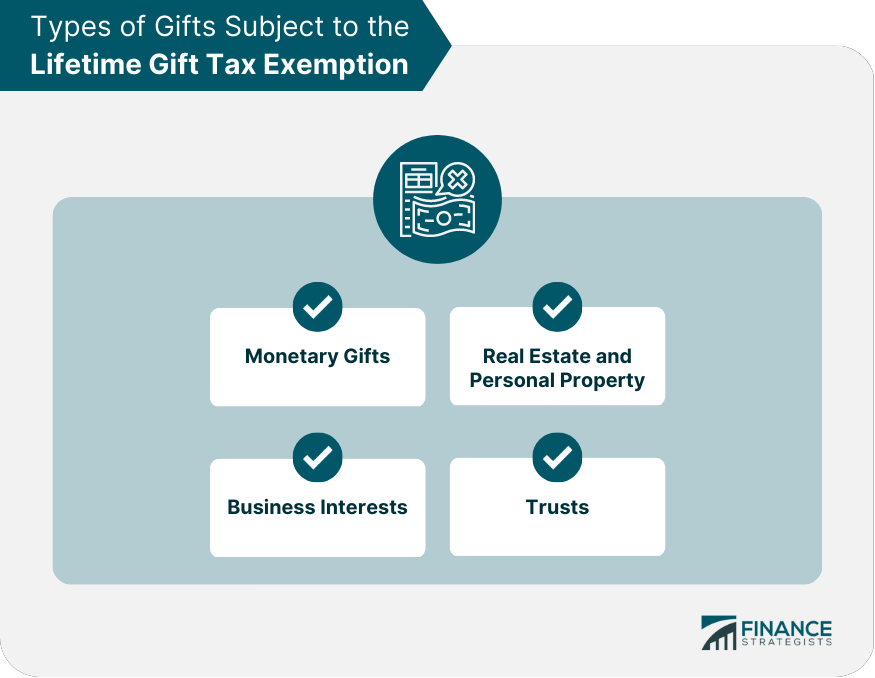

Lifetime Gift Tax Exemption 2025 & 2023 Definition & Calculation, In 2025, the annual gift exclusion will rise to $19,000 per recipient—an increase.

Lifetime Gift Tax Exemption Definition, Amounts, & Impact, Act now before the exemption changes.

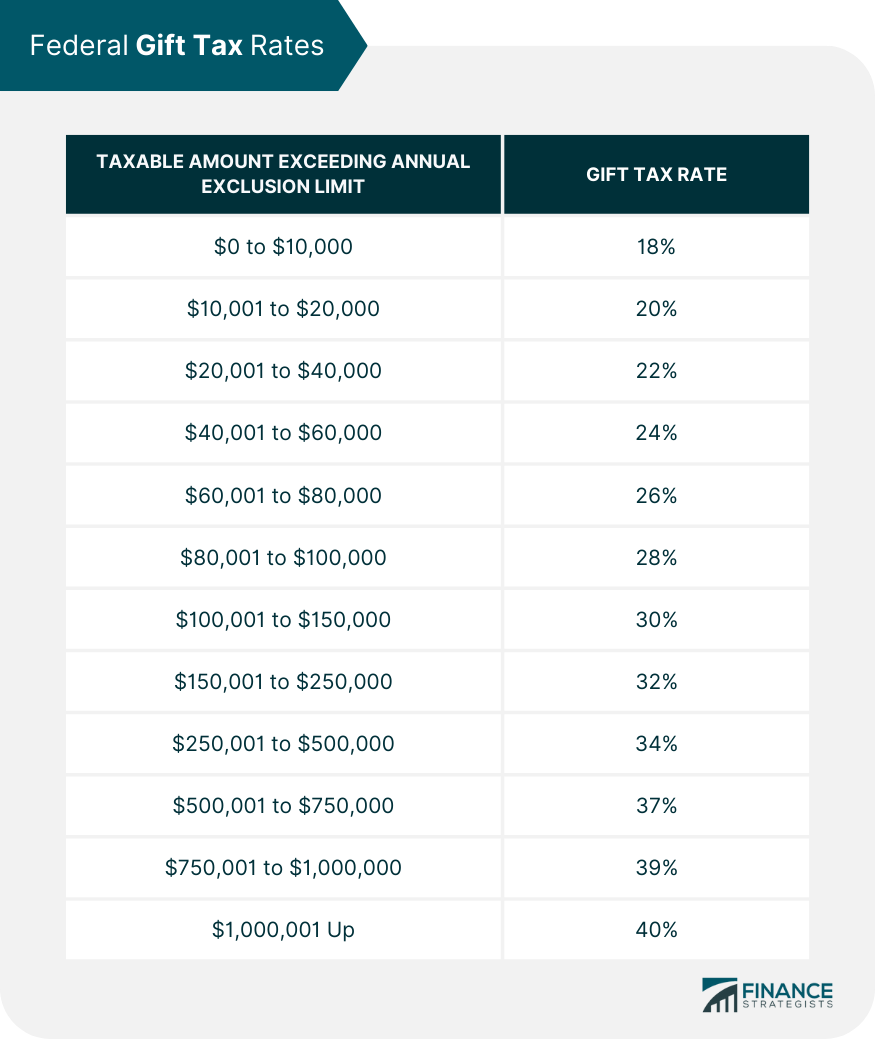

This means that an individual can gift up to $19,000 ($38,000 for a married couple) to any person. Another significant update is the annual gift exclusion amount, which has also seen an increase.

Federal Estate and Gift Tax Exemption to Sunset in 2025 Are You Ready, In 2025, the annual gift exclusion will rise to $19,000 per recipient—an increase.

Gift tax exemption rules who can receive gifts from relatives that are, Individuals can give up to $19,000 to any number of people in 2025 without triggering gift tax reporting requirements.

2025 Gift Tax Exemption For Individuals. In a significant update for estate planning and wealth management, the internal revenue service (irs) has announced an increase in the estate and gift tax exemption for 2025. Additionally, the lifetime estate and gift tax exemption will increase to.

Lifetime Gift Tax Exclusion 2025 Irs Harry Hill, This exclusion allows taxpayers to gift assets to.

Change on the Horizon Preparing for the Estate and Gift Lifetime Tax, These provisions, however, are set to.

Lifetime Estate and Gift Tax Exemption To Sunset In 2025 The Ray Group, This means you can give up to $19,000 to as many individuals as you want without having to pay gift taxes.

Lifetime Gift Tax Exemption 2025 & 2023 Definition & Calculation, The irs released the 2025 annual inflation adjustments for various tax provisions.